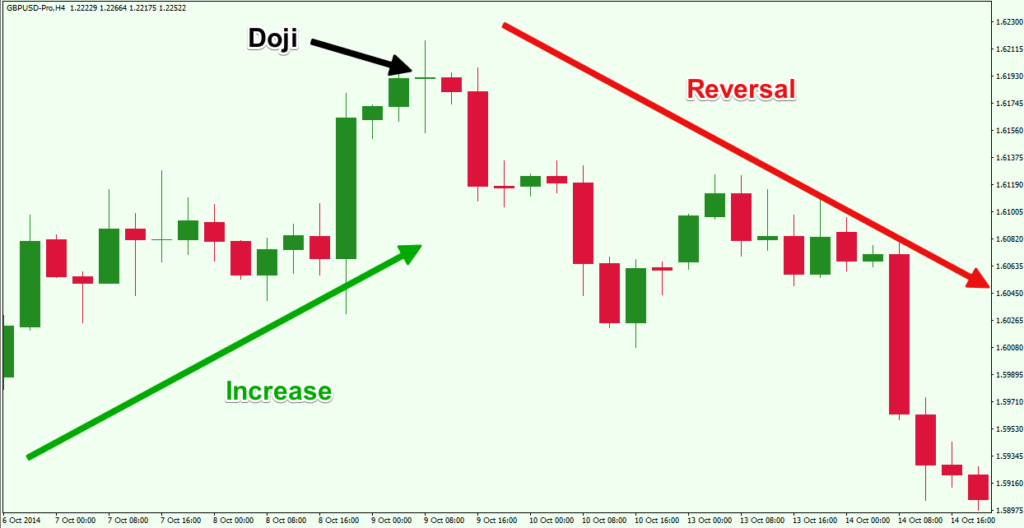

12/03/ · Doji. A Doji is a single candlestick pattern that is formed when the opening price and the closing price are equal. The lack of a real body conveys a sense of indecision or tug-of-war between buyers and sellers and the balance of power may be blogger.comted Reading Time: 2 mins 01/01/ · The doji is a special type of candlestick pattern that can signal a changing market. We can use it to try to understand the sentiment and to recognize times when the market strength is switching between buyers and sellers. Identifying a DojiAuthor: Forexop 06/06/ · The Doji candlestick, or Doji star, is characterised by its ‘cross’ shape. This happens when a forex pair opens and closes at the same level leaving a small or non-existent body, while Estimated Reading Time: 5 mins

What Is The Doji Candlestick Pattern & How To Trade With It - The Forex Geek

Last Updated: October 2, By Rayner Teo. The Doji is one of the most misunderstood candlestick patterns. Do you know there are 4 types of Doji and each has a different meaning to it? Most traders never figure this out. The most textbook teaches you that a Doji represents indecision in the markets, what doji means in forex. Depending on the length of the Doji, it could tell you what the market is likely to do in the near future this is important ….

Rome was not built in a day, and no real movement of importance ends in one day or in one week. It takes time for it to run its logical course. A Dragonfly Doji occurs when the opening and closing price is at the same level but, with a long lower wick. You know Support is an area where possible buying pressure could come in. A Gravestone Doji occurs when the open and close is the same price but, with a long upper wick.

So, what you want to do is go short when the price comes to Resistance and forms a Gravestone Doji. A Long Legged Doji occurs when the open and close is the same price but, what doji means in forex, with a long upper and lower wick relative to the earlier candles.

This means the market is undecided after a huge expansion in volatility which usually occurs after a big news event.

This means you can long the lows or short the highs of the Long-Legged Doji — ideally on the first test. So, look for a buildup to form as an entry trigger and trade the breakout.

If you want to discover the other candlestick patterns like the bullish engulfing, bearish engulfing, shooting star, hammer, etc strategy guides, then head over here for a full list of them.

If a Doji hammer forms in a down trend on the 4 hr I will look at the 30 minute chart to look at the next candle formation to see if it is bullish and how far what doji means in forex candle is from the 4 hr 50 MA to see if there is a chance of pullback.

To test that region The rest is fairly similar to how you describe especially at S and R however I look at the close of the next candle as in a trend a doji can also mean a rest. Love your work Man keep it up. Hello Rayner, since I knew a while ago the real meaning of the Doji has been trading with very good results, especially in trend markets Work D and 4H.

His super excellent explanation and clarifies more the concept he had. Thank you Illustrious. Translated by Google. Hi, can you pls help out in this scenario. uptrend with THREE fairly green candles moderate body.

I spot a dragon fly doji after consecutive three green candles being a RED dragonfly doji. How can I go further here? is it a likely bearish or bullish, what doji means in forex. If its an uptrend then it is likely to continue as sellers tried to push market lower but buyers didnt allow them to….

BTW area of value is what doji means in forex so make sure to take that into consideration. Nice one sir. The doji can it also be a long candlestick with a tail?. If not,what does a long candlestick with a tail signify?

The tail could be either up or down or both. Thank u. Thank you so much Rayner, i have been following only you since more than a month. All your videos are very what doji means in forex explained beautifully and what doji means in forex the point. However i just want to know if you can help out for screening stocks with any application which will help in identifying breakouts and swing trading.

The concepts and principles can be applied the same, as long as the market has sufficient liquidity. Rayner,I am a beginner I like your teaching and your write-ups I wish I can understand what doji means in forex and put it into practice.

I will like you to be my mentor, Will you? Even though I just started to learn a few days ago, it is very helpful. It makes sense. Thank you. Thank you for the explanations, what doji means in forex, very clear and to the point. I will apply them to my analysis on the candle chart patterns.

Truly appreciated! Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page. The Complete Guide to Doji Candlestick Pattern, what doji means in forex. For example: 1. Most traders never figure this out 2. A Doji occurs when the market opens and closes at the same price level. It means the market is undecided as neither buyers nor sellers are in control.

For example: If you spot a Doji in an uptrend, it means the market is temporarily in equilibrium. Think about it. A trend is made up of prices that have been moving higher. Moving on… A Dragonfly Doji occurs when the opening and closing price is at the same level but, what doji means in forex, with a long lower wick. And finally, the market closed at the what doji means in forex price where it opened.

This is a sign of strength as the buyers are in control. So, what you want to do is go long when the price comes to Support and forms a Dragonfly Doji. Because the market is telling you it has rejected lower prices and it could reverse higher.

This is a sign of weakness as the sellers are in control. Because the market is telling you it has rejected higher prices and it could reverse what doji means in forex. So here are 2 techniques to trade the Long Legged Doji… 1.

Meanwhile, the market is likely to be in a range to accumulate orders before it breaks out This means you can long the lows or short the highs of the Long-Legged Doji — ideally on the first test. Share 0. Tweet 0. Thanks for the beautiful write up Rayner. Very clear and succinct. Much appreciated. A tail signifies price rejection. The longer it is, the stronger the price rejection. I scan my trades manually. You have explained it so well that I have no confusion about doji.

Thank you, its very useful and your teaching is simple and straightforward. Much thanks for what you are doing for us the young traders. Close dialog. Session expired Please log in again.

Doji Candlesticks Secret No One Will Tell You

, time: 23:04The Complete Guide to Doji Candlestick Pattern

/DojiDefinition2-1356bb5eca0d47b5a086d2589b9a306e.png)

01/01/ · The doji is a special type of candlestick pattern that can signal a changing market. We can use it to try to understand the sentiment and to recognize times when the market strength is switching between buyers and sellers. Identifying a DojiAuthor: Forexop 12/03/ · Doji. A Doji is a single candlestick pattern that is formed when the opening price and the closing price are equal. The lack of a real body conveys a sense of indecision or tug-of-war between buyers and sellers and the balance of power may be blogger.comted Reading Time: 2 mins 26/07/ · July 27, The Forex Geek. A Doji candlestick Pattern can represent indecision in the market. This means neither the bull nor the bear is in control. In Japanese (the origin of candlestick patterns were from Japan), the word Doji means blogger.comted Reading Time: 5 mins

No comments:

Post a Comment