25/02/ · A butterfly spread is an options strategy that combines bull and bear spreads, with a fixed risk and capped profit. These spreads involve either four calls, four puts, or a combination 29/06/ · Butterfly pattern consists of 4 waves, and it is a reversal chart pattern in forex trading. To detect a butterfly pattern, specific Fibonacci retracement and extension levels are used This pattern is found in nature which is why it is being used in forex technical analysis. To increase probability of this pattern, specific Fibonacci levels are used The "Butterfly" pattern has a distinct retracement level () of XA swing. In bullish and bearish 5-point swings, the pattern must have to of XA swing to be valid. In perfect "Butterfly" patterns, the AB swing will be equal to CD (AB=CD). "Butterfly" patterns usually occur at market tops and market bottoms

Forex Butterfly Strategy - Forex4Trader

Indonesia Português Tiếng Việt ไทย العربية हिन्दी 简体中文 Nederlands Français Deutsch हिन्दी Italiano 한국어 Melayu Norsk bokmål Русский Español Svenska Tamil Türkçe Zulu.

Harmonic pattern strategies are a popular school of trading because of their accuracy every time they appear. It also shows you a new perspective on Price Action. In this article, I will show you how to trade Forex in IQ Option with the Butterfly pattern — a form of the Harmonic pattern. The Butterfly pattern is a Harmonic price pattern typically seen at the end of an extended price action. It is shaped like the letter M Bullish Butterfly or W Bearish Butterfly on the chart.

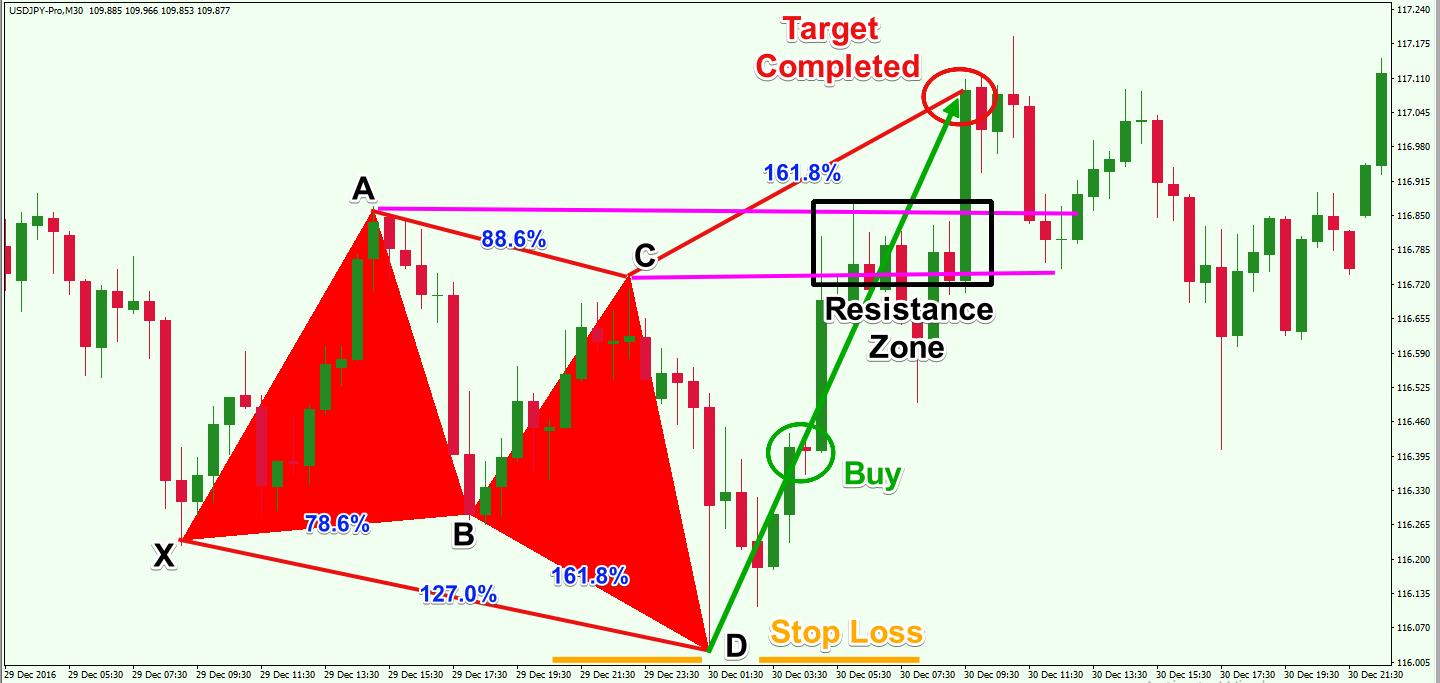

The Butterfly pattern also includes 5 points on the chart and these points are marked with the letters X, A, B, C and D. The point starts at X and goes through 4 swings XA, AB, BC and CD structure as shown below. To identify the Butterfly pattern, you will need to confirm that the price action is consistent with the Fibonacci ratios, butterfly strategy in forex. Note: The It is the first condition used to distinguish the Butterfly butterfly strategy in forex from other Harmonic patterns.

The Bullish Butterfly pattern starts with a bullish span XA — then the AB span declines — the BC span rises and finally a falling CD span once again exceeds the X bottom. Following this move combined with the corresponding proportions.

with the Fibonacci levels according to the above rule, butterfly strategy in forex, we predict the market will have an uptrend from point D. The Bearish Butterfly pattern is completely similar to the Bullish Butterfly pattern but reversed. It starts with a bearish XA span, followed by a bullish AB span, a BC drop and finally a CD rally again.

Follow this move in conjunction with the ratio corresponding to the Fibonacci levels according to the above rule, we expect the market to have a downtrend from point D. To enter a trade with the Butterfly pattern, you first need to identify it according to the rules above.

For easy tracking, you should mark butterfly strategy in forex important points X, A, B, C, D butterfly strategy in forex your chart. Then check the markers with the Fibonacci tool to make sure the pattern is correct. Open a BUY order at point D if the pattern is the Bullish Butterfly.

You should place the stop loss below the entry point, butterfly strategy in forex. Take profit will be the nearest top of the Butterfly Harmonic pattern. Open a SELL order at point D if the pattern is a bearish butterfly. You should place an automatic stop loss above the appropriate entry point. Take Profit will be the nearest bottom of the Butterfly pattern. Depending on the market conditions, you will have different ways to take profits.

It is more effective to use Fibonacci in combination with some other technical tools. The Butterfly Harmonic pattern offers the opportunity to trade right from the beginning of a new trend so traders can make more profits with less risk. The most important thing of this strategy is in the pattern identification stage. Therefore, you need to practice recognizing price patterns on a demo account before participating in making money from the Forex market in IQ Option.

Save my name, email, and website in this browser for the next time I comment. Notify me of follow-up comments by email. Notify me of new posts by email. Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

English Indonesia Português Tiếng Việt ไทย العربية हिन्दी 简体中文 Nederlands Français Deutsch हिन्दी Italiano 한국어 Melayu Norsk bokmål Русский Español Svenska Tamil Türkçe Zulu Home. IQ Option Trading Pro. Register IQ Option. Home Strategies How to use the Butterfly Harmonic pattern to trade Forex in IQ How to use the Butterfly Harmonic pattern to trade Forex in IQ Option. Contents 1 What is the Butterfly Harmonic pattern?

RELATED ARTICLES MORE FROM AUTHOR. How to use the reversal trading precisely with 3 RSI indicators in IQ Option. How to trade Forex with Gartley pattern in IQ Option. How to use the Harmonic patterns to trade Forex in IQ Option. LEAVE A REPLY Cancel reply. Please enter your comment! Please enter your name here. You have entered an incorrect email butterfly strategy in forex EDITOR PICKS. How to set up the perfect trading system in IQ Option September 18, How to use the reversal trading precisely with 3 RSI indicators September 12, butterfly strategy in forex, How to trade Forex with Gartley pattern in IQ Option July 28, POPULAR POSTS.

Doji candlestick patterns — How to identify and trade them in October 16, RSI indicator — How to use it and trade in IQ October 27, Support and resistance — The best technical indicator when trading butterfly strategy in forex October 19, POPULAR CATEGORY.

MORE STORIES. How to choose the market and trading time in IQ Option October 12, English Indonesia Português Tiếng Việt ไทย العربية हिन्दी 简体中文 Nederlands Français Deutsch हिन्दी Italiano 한국어 Melayu Norsk bokmål Русский Butterfly strategy in forex Svenska Tamil Türkçe Zulu.

Sniper Entry Strategy - Forex Trading

, time: 4:28How to Trade with Butterfly Pattern in Forex Market

The Butterfly Forex System is built on sound logic and simplicity. The chart is clean and anyone can easily spot high probability buy/sell signals without having to double guess or over-analyse. $ 23/07/ · The Butterfly pattern is a Harmonic price pattern typically seen at the end of an extended price action. It is shaped like the letter M (Bullish Butterfly) or W (Bearish Butterfly) on the chart. The Butterfly pattern also includes 5 points on the chart and these points are The "Butterfly" pattern has a distinct retracement level () of XA swing. In bullish and bearish 5-point swings, the pattern must have to of XA swing to be valid. In perfect "Butterfly" patterns, the AB swing will be equal to CD (AB=CD). "Butterfly" patterns usually occur at market tops and market bottoms

No comments:

Post a Comment