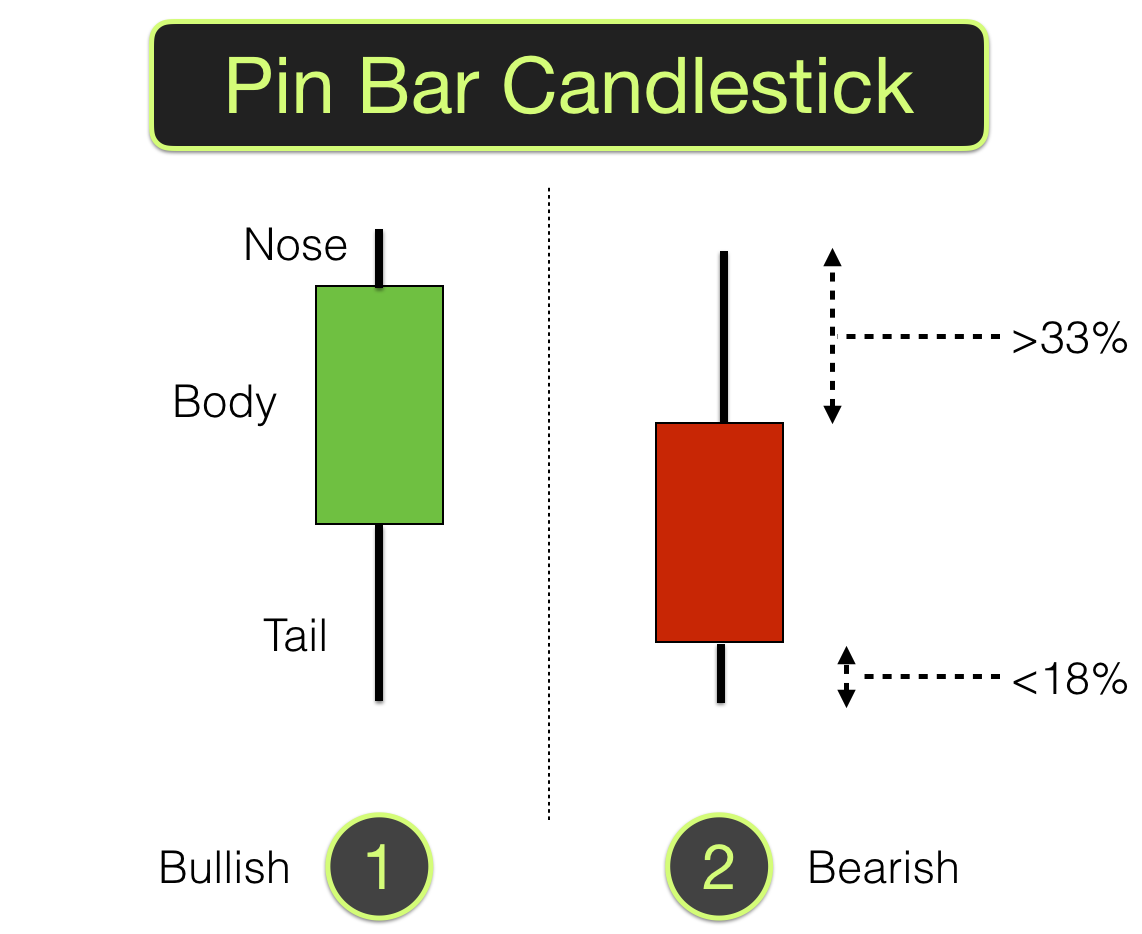

29/04/ · In other words, just because a candlestick has the form of a pin bar does mean it’s a trade-worthy pin bar signal. Pin Bar Fact: We want to trade a pin bar in the opposite direction the spiky tail (also known as the shadow) is pointing. So, a bullish rejection pin bar is one that rejects lower prices and thus tips off to take a long position Estimated Reading Time: 3 mins 25/02/ · The pin bar formation is a price action reversal pattern that shows that a certain level or price point in the market was rejected. Once familiarized with the pin bar formation, it is apparent from looking at any price chart just how profitable this pattern can be. Let’s go over exactly what a pin bar formation is and how you can take advantage of the pin bar strategy in the context of Images 22/06/ · Long-tail down in pin bar confirms price rejection from a support level. There is also a small shadow below the bearish candlestick and above the bullish candlestick. There are two conditions to determine a valid pin bar candle. body of pin bar candle must be less than 20% of total candle size. Tail or wick of the candle must be greater than 80%

'Pin Bar' Forex Trading Strategy - Pin Bar Definition » Learn To Trade The Market

Traders can potentially use price action alone to trade without the need to rely on other indicators. When doing this, they rely on Japanese candlestick patterns and formations, and one such pattern is the pin bar formation, which we will look at in great detail in this presentation. Traders try to identify reversal patterns, and pin bars are high on their list because they offer a high probability of success, and especially in volatile market conditions, pin bar candle forex.

Example A is what you would expect to see when looking for bullish or bearish pin bar formations. The formation is dependent on one single candlestick, pin bar candle forex, and will typically be pin bar candle forex than its immediate preceding candlesticks and represents a rejection of a move, followed by a sharp reversal.

The pin bar reversal, as pin bar candle forex is sometimes referred to, consists of a short body and a wick, or tail, which is at least three times the length of the body, thus making them easy to identify. Traders would read the formation as identifying a reversal in price action and a continuation in the direction of the wick. Example B looks at these shapes more closely and pin bar candle forex the expected move of any subsequent price action.

Example C shows a bullish pin bar trading strategy in action on a real chart of the USDCAD pair on a 4-hour chart. Here we can see a bullish reversal pin bar at position A. The reason that we can be fairly confident that this is a potential set up to move higher is because we can see that the previous candlesticks have found a support area as defined by our line and where candlestick A has gone down and touched that support area, only for the majority of the price action to be reversed.

Had we decided to take this trade on, we would have placed a stop loss just below the support line, and we can see that on this occasion, we would have been nicely rewarded with a push higher in price action.

In example D, we can see a bearish pin bar set up on the same pair at a later date, pin bar candle forex. The pair has witnessed a move higher and where at candlestick A we can easily identify a bearish pin bar setup. The subsequent candlestick moves lower, and this enforces our belief that we are going to get a reversal in price action and that indeed happens.

Had we taken on this trade and placed a fairly tight stop loss, pin bar candle forex, we would have been nicely rewarded again. A word of caution, trading pin bars is essentially gambling that price action will reverse in the opposite direction of which might have been a trend, and which is therefore almost counterintuitive.

Trading pin bars might pin bar candle forex a result of many factors including economic data releases, price action hitting key levels of support and resistance, or simply running out of steam, newsflow, policymaker speeches, or other unexpected events, and therefore we do not recommend that new traders use these setups to trade unless they are experienced.

However, pin bars can also offer a warning of when to exit a trade, rather than necessarily looking at it as an opportunity to trade in the opposite direction. Save my name, email, and website in this browser for the next time I comment. About Us Advertise With Us Contact Us. Forex Academy. Home Forex Forex Videos Master Forex By Trading Pin Bar Candlestick Formations. Pin Bar Candlestick Formations Pin bar candle forex can potentially use price action alone to trade without the need to rely on other indicators.

Example A Example A is what you would expect to see when looking for bullish or bearish pin bar formations. Example B Example B looks at these shapes more closely and identifies the expected move of any subsequent price action. Example C Example C shows a bullish pin bar trading strategy in action on a real chart of the USDCAD pair on a 4-hour chart. Example D In example D, we can see a bearish pin bar set up on the same pair at a later date.

RELATED ARTICLES MORE FROM AUTHOR. Beginners — Analysis Feature of MT4 Helps You Fund A Trading Strategy! Beginners How to pin bar candle forex a profile in Metatrader MT4! Forex USD Forecast this week! Will It Drop Again? LEAVE A REPLY Cancel reply. Please enter your comment! Please enter your name here. You have entered an incorrect email address!

Popular Articles. Forex Chart Patterns Pin bar candle forex Be an Illusion 4 September, How Important are Chart Patterns in Forex?

Chart Patterns: The Head And Shoulders Pattern 16 January, Academy is a free news and research website, pin bar candle forex, offering educational information to those who are interested in Forex trading. EVEN MORE NEWS. Understanding the Economics of Cryptocurrencies 13 June, pin bar candle forex, Trading Reversals Using Bullish Reversal Candlestick Patterns 12 June, Using Bollinger Bands to Time the Rectangle Pattern 11 June, POPULAR CATEGORY Forex Market Analysis Forex Brokers Forex Service Review Crypto Market Analysis Forex Signals Forex Cryptocurrencies Academy - ALL RIGHTS RESERVED.

EXTREMELY PROFITABLE Pin Bar Trading Strategy for FOREX SCALPING

, time: 10:16Where Traders Go Wrong With the Pin Bar Reversal

26/08/ · Pin Bar Reversal. The Pin Bar reversal is without a doubt one of the most powerful and reliable price action trading signals that can be traded across many different markets and time frames.. It is very simple to identify and most new traders can very quickly learn how to spot this two candle Estimated Reading Time: 10 mins 22/06/ · Long-tail down in pin bar confirms price rejection from a support level. There is also a small shadow below the bearish candlestick and above the bullish candlestick. There are two conditions to determine a valid pin bar candle. body of pin bar candle must be less than 20% of total candle size. Tail or wick of the candle must be greater than 80% 31/12/ · To confirm a candlestick is a Pin Bar in Forex, it must consist of the following characteristics: – Tail (aka wick or shadow): The Pin Bar is a candlestick with a long upper or lower tail. That is the highlight of a Pin Bar candlesticks that show a strong rejection of prices. A Pin Bar must have a tail that is at least 2/3 of the length of Estimated Reading Time: 5 mins

No comments:

Post a Comment