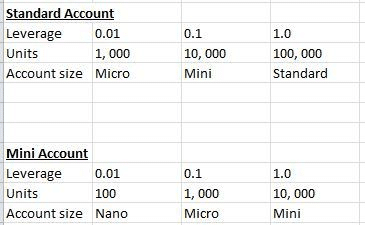

21/09/ · Micro Account: 1 lot = units EUR/USD pip value = $0,10 Mini Account: 1 lot = units EUR/USD pip value = $1 Standard Account: 1 lot = units EUR/USD pip value = $10 EFX's EUR/USD pip value remains always $0,10 The forex micro account lot size starts from 1, For the forex mini account, the lot size is 10, units. Whereas the standard account sized at , currency units. In the same way, each of these accounts has a different pip (percentage in point) reward, and it is lower for the micro and mini accounts You can actually trade 2, 3, or more standard lots, mini lots, or micro lots — as your account size (trading capital) allows you. Of course, 2 standard lots means , units of the base currency, just as 3 micro lots would mean 3, units of the base currency. How lot size affects the pip valueEstimated Reading Time: 7 mins

��Best Forex Brokers with Mini & Micro Accounts September | Learn 2 Trade

TOP FOREX BROKERS REVIEW. In this era of floating money, everyone knows about forex trading. But most people don't know where to start as there are multiple account types are available for forex traders. However, you may consider a forex mini account or forex micro account if you are a beginner. You can understand these account types from the name. These accounts allow anyone to trade through the smaller size of investments. Our expert team micro mini standard forex account a comprehensive list of top 10 forex mini account brokers and forex micro account brokers.

Also check out our compared forex mini vs micro account types, so you can choose the right one according to your trading style. In other words, micro or mini accounts don't require a large investment. The micro account can be operated with 1, units, and this is a most simple method to start for the new traders or the experts who want to test a broker before pushing any investment.

On the other hand, the forex mini account deals with 10, units. If you are looking for a great kickoff to your forex career or even looking for new forex trading platforms to work with, you have reached the right page. Throughout the article, we will share everything related to both micro and mini forex accounts and the ways to choose forex mini account brokers and the forex micro account brokers.

Basically, a forex micro or forex mini account is a forex trading account that comes with a smaller lot size position. Therefore, these kinds of accounts lower the possible risks, perhaps reduce the losses.

Micro mini standard forex account, both accounts fall in the same category, but the micro account is much smaller lots than the forex mini account, micro mini standard forex account. However, forex accounts are categorized into three main contract sizes, and the accounts are micro, mini, and standard.

Let's see the basics of each account size. In the same way, each of these accounts has a different pip percentage in point reward, and it is lower for the micro and mini accounts. This certainly minimizes the risk and helps you to understand a forex broker and forex trading. Visit Broker Rank Broker Reviews Location Minimum Deposit Amount Deposit Bonus Payment System Rating Create an Account 3 IC Markets. FP Markets.

Admiral Markets. FBS Markets. Basically, the forex micro account and mini accounts are for the new and inexperienced traders as it offers a tiny contract size. So, the useability of these accounts makes sense as they don't have any chance of micro mini standard forex account loss.

Therefore, micro and mini accounts can be very useful for the traders who are still in the learning stage or even thinking of starting forex trading. Usually, the micro and mini accounts get the opportunity to the traders as the standard account holders. So, the account holders will be able to access charts, tools, analysis, platforms, and more. The working procedure is simple; the micro account holders will need to take positions in multiples of 1, units while the mini account holders will enter multiple of 10, units, micro mini standard forex account.

The good thing about the smaller lot size is, it enables the traders to trade diversely. This can be done by ordering a selection of currency pairs.

Moreover, a newbie trader can get an idea about the risk and will not feel anything if they fail. However, every investor makes the investment with the hope of shifting the currency pair. This shift or price change is known as pip movement. Nevertheless, the quotation price shows up to four decimals.

However, the decimal places can be changed for other currencies. For instance, the Japanese Yen shows the rate in two decimal places. So, the Japanese Yen can be shown as In the forex trading market showing the price shifts using pips is normal. However, the pip represents a small price change for a currency. The price change is measured in fractions, which means that the amount gained or lost while trading will be very small, micro mini standard forex account.

As a result, micro or mini accounts, as well as the standard accounts, calculate the currency units through lot sizes. Further, the pip rates are variable, and they will change according to the currency pairs as well as the price of the base currency.

However, micro mini standard forex account, the rate changes based on the quote currencies. As we have mentioned earlier, micro mini standard forex account, a standard lot is , which means that a considerable investment is needed if anyone wants to make a purchase with no leverage. So, the gains for different account types will be. Now, imagine the euro goes down to 1. So, the loss calculation will be. However, micro mini standard forex account, forex brokers normally offer leverage on each account type so that the traders can take a position on risky trades through a small number of outlays.

Brokers tend to credit the broker's account with extra funds to take a position in the large amount, micro mini standard forex account. So, whenever a trader is winning, he or she can order more currencies with the leverage and increase the gaining percentage.

Whenever you sign up with a broker, micro mini standard forex account, you will find their leverage offerings such as, something like that. So, for a mini account positionedsized forex mini lot will get 1, or 2, extras to increase the position. However, you have to keep in mind that leverage will increase not only the profitability but also losses too.

Let's explain with the example of 75 pip gains we have used previously. As many of the forex enthusiasts jumped to the forex marketthe brokerage firms seemed to have a competition to grab more clients. Hence, the brokers offer many benefits to grab the attention of the traders. Further, the brokers also offer forex mini account and micro account forex to encourage the newbies, which makes the new traders confused to select the best forex broker.

With this in mind, we have sorted out the best forex mini account brokers and forex micro account brokers so you can choose the right one according to your trading style. This is the foremost and important task to select the right broker. So, whenever you intend to register with a broker, don't forget to check their regulatory status and licenses. We recommend everyone to do this because there are numerous scam brokers that lure new and inexperienced traders.

You will need to know the broker's location and check the broker's regulatory status accordingly. For example, UK brokers should be licensed by the FCA regulatory body. It is responsible for controlling the brokers from the UK and works as a safeguard of the trader's hard-earned money.

FCA makes sure that the brokers are legitimate and manages the trading account fairly. Further, other major forex regulatory bodies globally, such as ASIC Australia or even the CySEC Cyprus , also ensure the traders' safety and make sure their investments don't get scammed. Find out our forex mini account brokers and forex micro account brokers list to choose the right account type with trusted and regulated broker. However, by any chance, micro mini standard forex account, if you sign up with unregulated brokers or forex trading scams brokersthe regulatory bodies might micro mini standard forex account be able to help you out in case you get scammed.

Hence, it is mandatory to check the broker's reputation and regulatory status before you decide to sign up with that. Since you will be trading forex, you will need to play multiple currency pairs as you are in the learning phase. But having access to other minor currencies will certainly help you to gain experience. Moreover, the multiple currency pairs can help you toward creating a diverse forex portfolio. So, it would be great if you choose a micro or mini forex broker with a wide selection of currency pairs, including the majors, minors, and exotics.

You find the currency pair offerings on the broker's website. Signing up with a broker will not just get you access to the forex world. Instead, you will need an intermediary to access the currencies via the broker. Forex trading platforms are such a bridge between the broker and the forex world that helps the traders to trade. So, access to the top, not the trading platform, is necessary. MetaTrader brokers are currently chosen by most traders, as this platform is easy to use and offers tremendous benefits to the traders and brokers.

MetaTrader has two trading platforms MT4 and MT5. Micro mini standard forex account, you may choose a MetaTrader 4 forex brokers or MetaTrader 5 forex brokers to trade via mini or micro-accounts.

The access to the forex trading tools depends on the broker and platforms. Tools accelerate the trading capability and also offer many opportunities for the traders. For example, economic calendars and financial news are kinds of trading tools that can make the trader aware of any movements in the micro mini standard forex account market depending on any economic events.

Moreover, forex tools offer to study the historical data of a currency alongside the fundamental news analysis. These things can boost forex success. The tools also offer different technical indicators that help to analyze the forex market and assist you in taking any decision or changing the forex strategy. However, tools may vary from broker to broker. So, it is advisable to check out and understand all the tools offered by a broker and compare them with other brokers.

In this way, you can choose a broker with the highest benefits. Commissions are the main way that a broker can earn money. There, some brokers tend to charge more commissions than others to earn money. However, some brokers may charge a little commission and offer a lot of benefits.

So, check out the fees and commission structure of a broker before you decide to trade with them. However, brokers may offer a variable commission structure. But if you trade with reputed, you may not need to pay variable fees. Instead, the fees might be lower.

Micro vs Standard Account Type Forex Trading Philippines

, time: 13:17Forex Mini Account Brokers | Forex Micro Account Brokers

The forex micro account lot size starts from 1, For the forex mini account, the lot size is 10, units. Whereas the standard account sized at , currency units. In the same way, each of these accounts has a different pip (percentage in point) reward, and it is lower for the micro and mini accounts 04/07/ · A mini forex trading account involves using a trading lot that is one-tenth the size of the standard lot of , units. In a mini lot, one pip of a currency pair based in U.S. dollars is equal to $1, compared to $10 for a standard-lot trade. The demand for micro accounts when trading forex is particularly high with new traders. Mini and micro accounts have remained an essential part of the forex You can actually trade 2, 3, or more standard lots, mini lots, or micro lots — as your account size (trading capital) allows you. Of course, 2 standard lots means , units of the base currency, just as 3 micro lots would mean 3, units of the base currency. How lot size affects the pip valueEstimated Reading Time: 7 mins

No comments:

Post a Comment