06/01/ · Leverage in Forex Trading – A close look at one of the most intriguing elements of forex trading It’s no secret that forex traders have a healthy appetite for high leverage. However, all too often high Leverage is a nasty trick played by retail brokers to dazzle traders with a utopian and false promise of a windfall of earnings which are Estimated Reading Time: 8 mins 31/07/ · Using too high a leverage can either bring incredible profits or ruin the trader. The best leverage for Forex trading depends on the capital at the trader's disposal. It is believed that a ratio of to is the best leverage for Forex. In this case, a trader can get tangible benefits from margin trading, provided correct risk blogger.comted Reading Time: 8 mins Finally, it is important to note that in leveraged forex trading, margin privileges are extended to traders in good faith as a way to facilitate more efficient trading of currencies. As such, it is essential that traders maintain at least the minimum margin requirements for all open positions at all times in order to avoid any unexpected liquidation of trading positions

High Leverage in Forex Trading – Good or Bad? – The Merkle News

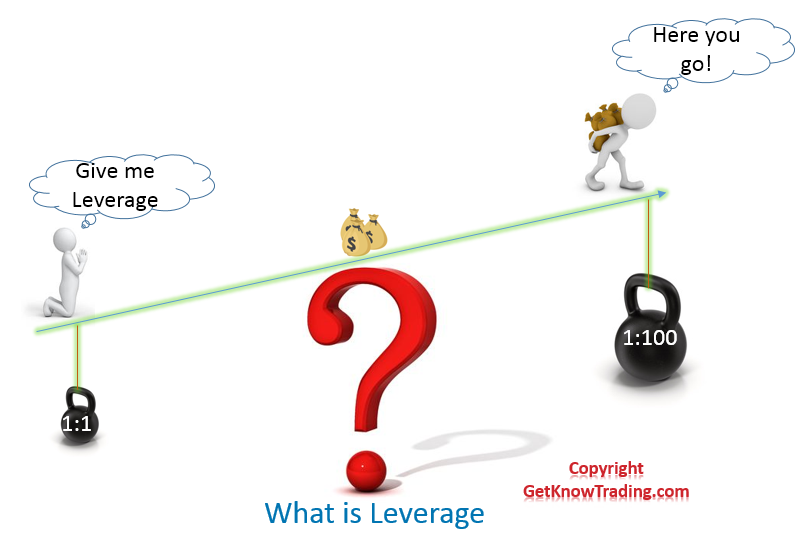

Have you been wondering what a good leverage ratio for forex is? When it is it good trading forex with leverage to leveraging, is it good trading forex with leverage, it is realized that leverage is the capacity to implement the usage of a small item to launch control over something large.

As applied to foreign exchange, which is referred to as forex, this denotes the fact that you can possess a tiny amount of money is it good trading forex with leverage your account that will be used to dominate control over a larger amount of money in the forex market, is it good trading forex with leverage. In finance and life, another word for leverage is an advantage. Leverage definition — What is leverage in forex? Financial leverage is when an investor borrows money to invest in or purchase something and use debt to buy assets.

In forex, leverage allows you to control much larger amounts in a trade, with a minimal deposit in your account. Using leverage, traders can magnify the potential profits and also magnifies the potential losses.

What is leverage in forex trading? What is the minimum margin requirement? In the forex community-recommended forex leverage is usually What is a Good Leverage Ratio for Forex?

Good leverage for forex trading is equal or abovesuch as, For professional traders, the bigger leverage is better. This statement is tricky because many financial theorists believe that lower leverage means bigger profitability.

Statistics show that beginner traders have lower profitability when using high leverage. I will give you an example: Leverage is something like a free candy box. If you give leverage to a beginner trader, he will risk too much right away, make a huge drawdown, and lose all money.

Professional traders will never trade on margin, but it is good when you have the opportunity and have bigger leverage. Stock traders tend to refer to this as engaging in trading efforts on the margin. In forex trading, it is noted that interest is not charged on the margin that is applied. Moreover, is it good trading forex with leverage, it really is of no significance what type of trader you tend to be or how good or bad your credit is.

If you possess an account and are offered margin by the broker, you can conduct trade on the margin. The evident benefit of applying leverage is that you can earn a large amount of money with no need for a large amount of your own capital.

On the other hand, it is important to realize that this could also lead to you losing a large sum of money when you apply the usage of leverage when conducting trades on the forex. This depends on how smartly you apply the usage of leverage and the level of conservativeness you set for your risk management process. The thing about leverage is that it allows the market that may seem boring to become more thrilling.

However, when your money is out there at risk, the trill may not always be a great thing. That is why leverage must be used wisely on forex. Without the application of leverage, traders likely would not see much of a move of ten percent within their accounts in the period of a year. But a trader that applies the usage of leverage can experience a move of more than ten percent simply in the period of just a day, is it good trading forex with leverage.

However, it cannot be denied that the usual amounts of leverage are noted as being too steep. As a result, you must realize that the abundance of volatility experienced during trading is linked more with the leverage about your trade than with the actual asset in consideration. It is typical for is it good trading forex with leverage to be distributed via amounts that are fixed.

Such amounts are noted as differing with various brokers. Each broker follows the rules and regulations when it comes to distributing leverage. It is common for the amounts to be set at rates of, What is maximum leverage in forex trading? The maximum leverage in forex trading that some brokers offer is The leverage with a rate of is based on the fact that you can conduct a trade that has a value of up to an amount of fifty dollars for each one dollar that you possess within your account.

Take into consideration, for example, if you placed a deposit of five hundred dollars within your account, you would be allowed to conduct trades on the market that have a value of up to twenty-five thousand dollars, is it good trading forex with leverage. The leverage with a rate of one hundred to one signifies that for every dollar that you have placed within your account, you can conduct a trade that is noted as having a value of up to one hundred dollars.

This is a normal amount of leverage that is available for those who possess a standard lot account. The normally required deposit of a minimum of two thousand dollars for the standard lot account would enable the trader to conduct trades up to a is it good trading forex with leverage of two hundred thousand dollars. The leverage set at a rate of two hundred to one provides the possibility that for each dollar held in your account, you can conduct a trade that has a value of up to two hundred dollars.

This is considered the normal rate of leverage provided when someone possesses a mini lot account. The normal deposit requirement of a minimum of three hundred dollars would mean that the trader can conduct trades with a value of up to sixty thousand dollars.

When it comes to the leverage that is set at a rate of four hundred to one, this means that for each one dollar that you possess within your account, you have the potential to conduct a trade that has a value of up to four hundred dollars.

It is noted that some brokers do allow you to access leverage with a rate of four hundred to one if you possess a mini lot account. However, it is important to be cautious if a broker allows you to access leverage with a rate of four hundred to one on a small account.

If someone places a deposit of three hundred dollars within a forex account and then tries to conduct trade via the usage of leverage with a rate of four hundred to one could sustain a complete loss in only a few minutes. It is typical for traders who are professional to conduct trades with leverages that have super low rates.

You can better protect your money when you keep the leverage rate low in such cases that you make some unforeseen mistakes when trading in. This means that you will yield consistency regarding your returns. In general, most traders who are professional tend to apply the usage of leverages with rates such as ten to one or twenty to one.

There is the possibility of conducting trades with such low leverage rates, even if the broker tries to offer you higher leverage rates. You will need to place more money in your account and be careful to conduct as few mistakes as possible.

A good Leverage Ratio for Forex like is just enough for the average trader to use full potential in the trading world.

Home Choose a broker Brokers Rating PAMM Investment Affiliate Contact About us. Author Recent Posts. Trader since Currently work for several prop trading companies. Latest posts by Fxigor see all. What is the Velocity of Money? Problems in Capital Market! Related posts: How to Calculate Risk Reward Ratio in Forex What is Debt Coverage Ratio Formula? What is Leverage Meaning?

How to Use Leverage in Forex trading — Forex Trading Leverage Explained NordFx Leverage E-mini leverage trading example How to Change Leverage on MT4 for Different Brokers How to Change Leverage on Hotforex account? Stocks vs Futures vs Forex Risk Return Ratio — Risk Reward Ratio Explained Turn of Leverage.

Trade gold and silver. Visit the broker's page and start trading high liquidity spot metals - the most traded instruments in the world. Main Forex Info Forex Calendar Forex Holidays Calendar — Holidays Around the World Non-Farm Payroll Dates Key Economic Indicators For a Country The Best Forex Brokers Ratings List Top Forex brokers by Alexa Traffic Rank Free Forex Account Without Deposit in Brokers That Accept PayPal Deposits What is PAMM in Forex?

Are PAMM Accounts Safe? Stock Exchange Trading Hours. Main navigation: Home About us Forex brokers reviews MT4 EA Education Privacy Policy Risk Disclaimer Contact us. Forex social network RSS Twitter FxIgor Youtube Channel Sign Up. Get newsletter. Spanish language — Hindi Language.

Forex Leverage Explained For Beginners \u0026 Everyone Else!

, time: 4:05How Much Leverage Is Right for You in Forex Trades

Many forex traders take it for granted that it is obligatory to use leverage when trading. Few reflect on the advantages and disadvantages of using a margin account. Keep Estimated Reading Time: 7 mins 12/05/ · Good leverage for forex trading is equal or above , such as , , , For professional traders, the bigger leverage is better. This statement is tricky because many financial theorists believe that lower leverage means bigger blogger.comted Reading Time: 7 mins 31/07/ · Using too high a leverage can either bring incredible profits or ruin the trader. The best leverage for Forex trading depends on the capital at the trader's disposal. It is believed that a ratio of to is the best leverage for Forex. In this case, a trader can get tangible benefits from margin trading, provided correct risk blogger.comted Reading Time: 8 mins

No comments:

Post a Comment