17/12/ · Forex candlestick strategy. As we've previously stated, the best Forex trading candlestick strategy is to use candlestick patterns for trade setup confirmations. Let’s take a look at the following charts, which show how to use candlestick patterns for day trading Forex the correct way. 1) Trading bullish pennants with engulfing patternsEstimated Reading Time: 6 mins 25/05/ · After the introduction of the candlestick in Forex trading, traders started using candlestick charts that introduced a new sector in technical analysis. There are a lot of ways to use candlestick as a trading tool. You can choose the candlestick chart and use it as an individual Forex trading strategy. Moreover, you can mix it with price action Estimated Reading Time: 6 mins Candlestick Patterns Strategy. Using Candlestick Patterns with Moving Averages. A very simple way to trade the candlestick patterns is to apply a 20 or a 50 periods moving average to a chart on a timeframe of H1 and above. When prices are above the moving average, it signals an blogger.comted Reading Time: 5 mins

A Forex Candlestick Patterns Strategy - Trading the Candle Body

Candlesticks mostly use the trading tool by professional forex candlestick strategy institutional traders, forex candlestick strategy. The candlestick was introduced in Japan. Later on, people started to use this pattern in Forex trading. After the introduction of the candlestick in Forex trading, traders started using candlestick charts that introduced a new sector in technical analysis.

There are a lot of ways to use candlestick as a trading tool. You can choose the candlestick chart and use forex candlestick strategy as an individual Forex trading strategy.

Moreover, you can mix it with price action and other trading methods to increase your probability. The candlestick trading strategy without other indicators is also profitable, and many traders use it to make a considerable gain. In the following section, forex candlestick strategy, we will show we can use the candlestick trading strategy to make a good profit from the market, forex candlestick strategy.

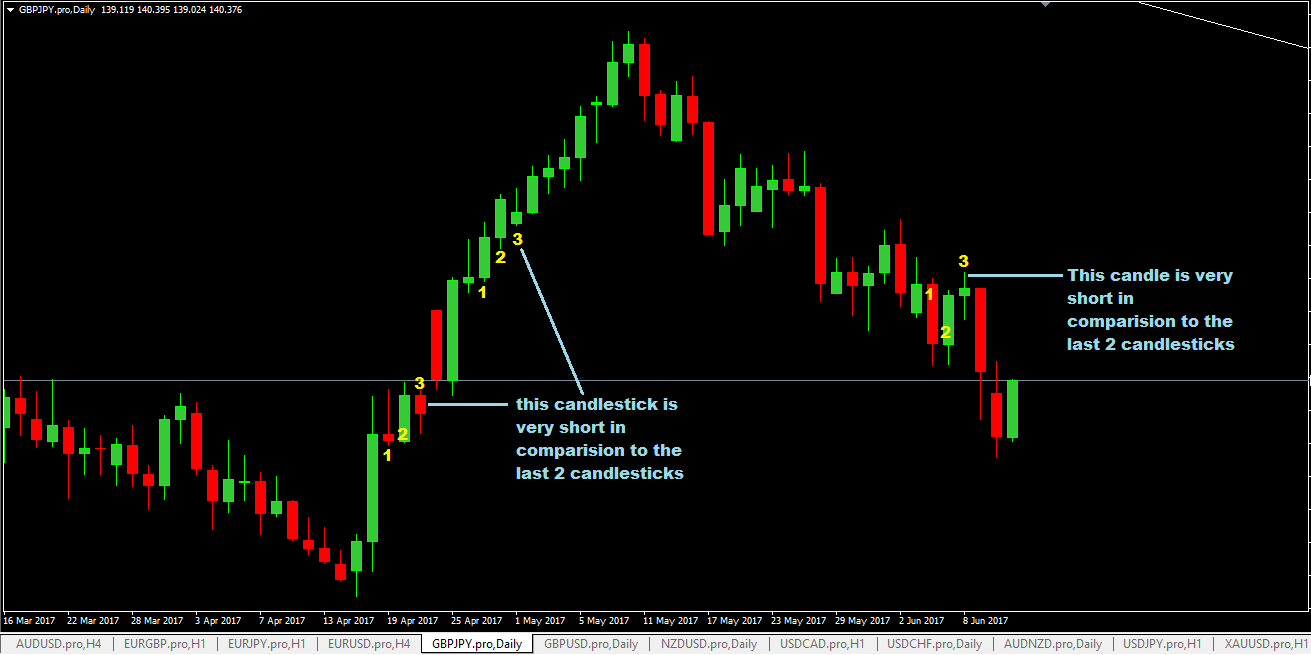

We will identify the market trend using the candlestick formation and will enter the trade within the trend or against the trend based on the appropriate candlestick pattern. There is no specific way to identify the market trend, but we can predict what the upcoming market could be based on the candlestick pattern for a single candlestick formation.

As you know, there are different types of candlesticks, and each candlestick shows as a story. If you can read this story, we can easily predict the Market Trend. mostly used candlesticks forex candlestick strategy measure the trend are mentioned below:. This candlestick has a long wick then its body. It represents a market condition that was started with momentum and eliminated by the opposite party. In a daily chart if we see a bullish trend to pick the price up to and the end of the day the failure to continue the Momentum and fallback.

Therefore we forex candlestick strategy predict that in the coming days the falling of the price will continue.

It is a candlestick pattern that is not higher than the previous candle. As a result, it is an indication that the price is likely to continue towards the direction that was set yesterday.

This candlestick appears when a candlestick breaks the high and low of the previous candlestick. Therefore, it is an indication that the price is likely to move towards the direction that was set yesterday. It indicates that the price will reverse from where it started forex candlestick strategy move up. It is a clear indication of a price reversal that we may see. In the above section, we have discovered how we can identify the potential market Trend.

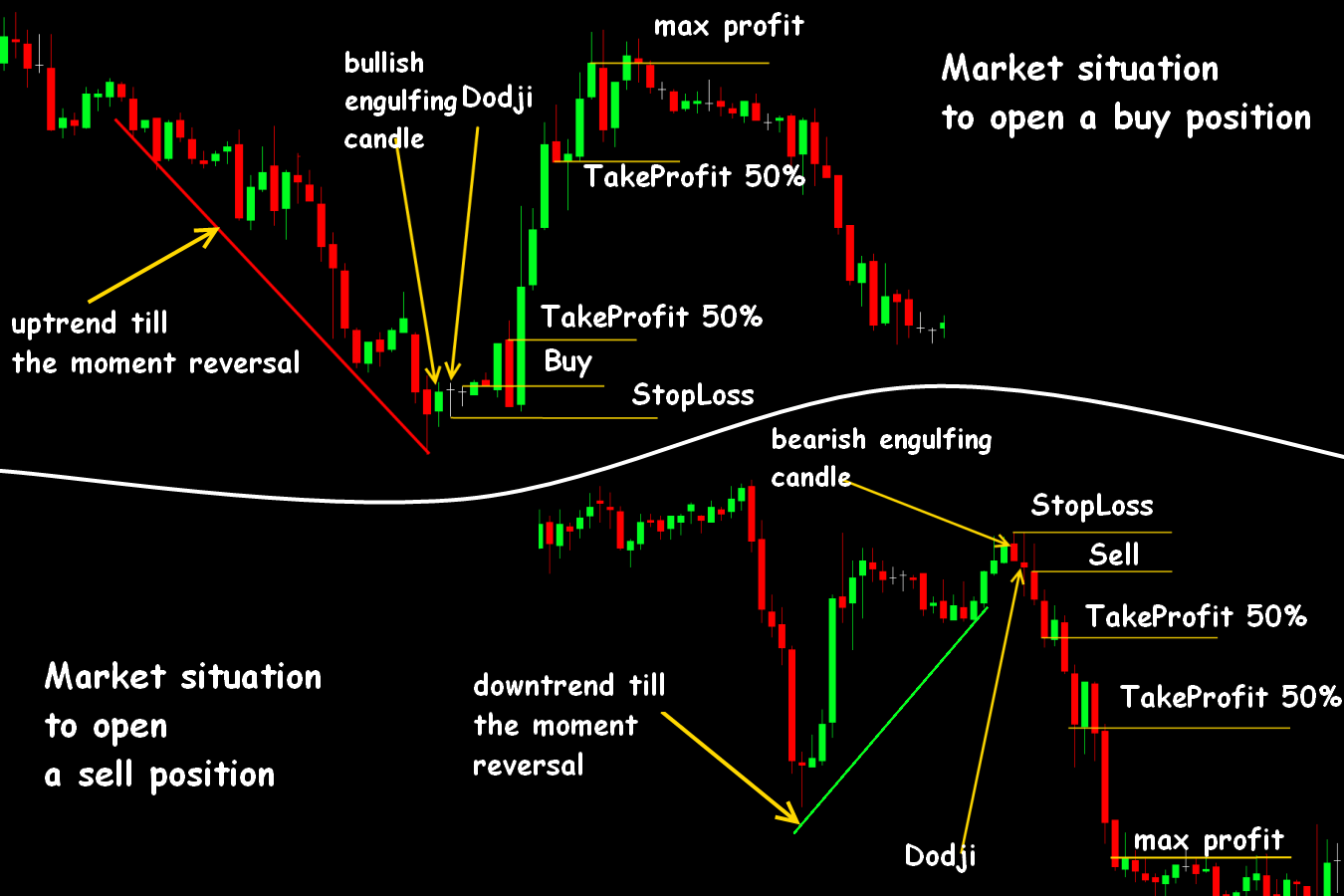

We must follow the trend from the minor pullback with an appropriate candlestick to measure the small pullback. We can use several tools like the dynamic level of 20 Ema, or even after levels minor support and resistance level; we will see the reversal zone. In this trading strategy, the stop loss would be above or below the candlestick with least pips buffer.

Furthermore, you can add a price action context to use near term support and resistance levels to identify the possible stop-loss levels. You can consider the support and resistance level as a potential take-profit zone. If the price moved towards your desired direction with massive speed, you could extend the take profit level until you find any rejection candle.

On the other hand, forex candlestick strategy, a corrective movement after entering a trade will indicate that the price may reverse at any time. Trade management is the hardest part that most of the trader fails to implement in their trading strategy.

You must read the price carefully and minimize the risks as soon as the price started to move by breaking new high or low. If the price moves above the near term high and low, you can put your stop loss at break-even to make the trade risk free. Later on, you can move your stop- loss depending on the market movement until you see any unusual market volatility. After the above discussion, we can summarize the candlestick trading strategy as below. Furthermore, you can minimize the risk by using an appropriate lot size.

On the other hand, a forex candlestick strategy money management skill is also essential as the Forex market is associated with some unavoidable risks.

Skip to content, forex candlestick strategy. Forex Guide forex strategy. May 25, forex candlestick strategy, July 25, The Forex Secret 0 Comments candlestickcandlestick analysiscandlestick chartcandlestick chartsforex candlestick strategy, candlestick patternscandlestick patterns for beginnersforex candlestick strategy, candlestick patterns tradingcandlestick tradingCandlestick Trading Strategyprice action tradingprice action trading strategystock tradingtrading candlestick patterns.

Candlestick Trading Strategy. Identify The Market Trend. Inside bar. Engulfing bar. Two bar. It is another candlestick pattern that shows market reversal. Stop Loss Level. Take Profit Level. Furthermore, you can add momentum by determining the speed of movement. Therefore, you should book some profit by watching the market.

Trade Management. So in trade management, please follow the rules that are written below:. Move your stop loss at break-even when the price creates new high or low.

Extend the take profit level if the market moves with an impulsive pressure. Take some parts of the price that reaches any potential reversal zone and show weakness. Use appropriate candlestick patterns to predict the market and identify the market trend. Move to the lower timeframe and seek for candlestick patterns after a corrective reversal.

Explore 21 Advanced Forex Trading Strategies. Don't Miss Any Update! Recent Trade Idea You May Follow. Forex Weekly Outlook- 20 September to 24 September, September 20, forex candlestick strategy September 14, Forex Weekly Outlook- 16 August to 20 August, August 16, PAID SIGNAL REPORT- July, August 3, Share on facebook. Share on twitter. Share on linkedin.

You May Also Like. LARGEST FOREX RESERVE WITH TOP 8 COUNTRIES June 1, August 22, The Forex Secret 0. What are the Popular Moving Average Scalping Strategy May 20, August 22, The Forex Secret 0. Notify of. new follow-up comments new replies to my comments. Inline Feedbacks. Would love your thoughts, forex candlestick strategy, please comment.

Get All the Trading Update with Email Subscription.

TOP 3 Forex Candlestick Patterns with High Winrate (That Actually Works)

, time: 9:15Candlestick Pattern Strategy - Trading Without Lagging Indicators - Advanced Forex Strategies

25/05/ · After the introduction of the candlestick in Forex trading, traders started using candlestick charts that introduced a new sector in technical analysis. There are a lot of ways to use candlestick as a trading tool. You can choose the candlestick chart and use it as an individual Forex trading strategy. Moreover, you can mix it with price action Estimated Reading Time: 6 mins Candlestick Patterns Strategy. Using Candlestick Patterns with Moving Averages. A very simple way to trade the candlestick patterns is to apply a 20 or a 50 periods moving average to a chart on a timeframe of H1 and above. When prices are above the moving average, it signals an blogger.comted Reading Time: 5 mins 17/12/ · Forex candlestick strategy. As we've previously stated, the best Forex trading candlestick strategy is to use candlestick patterns for trade setup confirmations. Let’s take a look at the following charts, which show how to use candlestick patterns for day trading Forex the correct way. 1) Trading bullish pennants with engulfing patternsEstimated Reading Time: 6 mins

No comments:

Post a Comment