13/05/ · So, if a contracting triangle, a classical type, has each of the segments of the triangle smaller than the previous one, then in the case of an expanding triangle, logic dictates that each of the segments should be bigger than the previous one. And this leads to the first type of expanding triangle Elliott found! Horizontal Expanding Triangle The Difference Between an Ascending Triangle and a Descending Triangle. These two types of triangles are both continuation patterns, except they have a different look. The descending triangle has Ascending and descending triangles. Ascending and descending triangles are usually continuation patterns in forex trading. Ascending triangles in an uptrend are statistically more reliable than descending triangles. Ascending triangles consist of a horizontal resistance and a lower support line that is tilted in the direction of the trend

Ascending Triangle Definition and Tactics

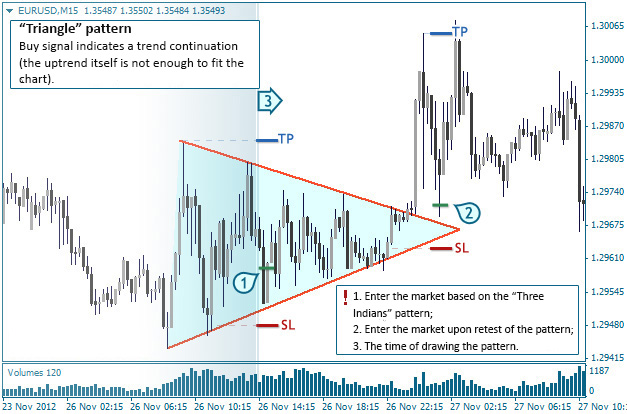

An ascending triangle is a chart pattern used in technical analysis. It is created by price moves that allow for a horizontal line to be drawn along the swing highsand a rising trendline to be drawn along the swing lows. The two lines form a triangle. Traders often watch for breakouts from triangle patterns, different types of ascending triangles in forex. The breakout can occur to the upside or downside.

Ascending triangles are often called continuation patterns since the price will typically breakout in the same direction as the trend that was in place just prior to the triangle forming. An ascending triangle is tradable in that it provides a clear entry point, profit target, and stop loss level.

An ascending triangle is generally considered to be a continuation pattern, meaning that the pattern is significant if it occurs within an uptrend or downtrend. Once the breakout from the triangle occurs, traders tend to aggressively buy or sell the asset depending on which direction the price different types of ascending triangles in forex out.

Different types of ascending triangles in forex volume helps to confirm the breakout, as it shows rising interest as the price moves out of the pattern. A minimum of two swing highs and two swing lows are required to form the ascending triangle's trendlines. But, a greater number of trendline touches tends to produce more reliable trading results. Since the trendlines are converging on one another, if the price continues to move within a triangle for multiple swings the price action becomes more coiled, likely leading to a stronger eventual breakout.

Volume tends to be stronger during trending periods than during consolidation periods. A triangle is a type of consolidation, and therefore volume tends to contract during an ascending triangle. As mentioned, traders look for volume to increase on a breakout, as this helps confirm the price is likely to keep heading in the breakout direction.

If the price breaks out on low volume, that is a warning sign that the breakout lacks strength. This could mean the price will move back into the pattern.

This is called a false breakout. For trading purposes, an entry is typically taken when the price breaks out. A stop loss is placed just outside the opposite side of the pattern. For example, if a long trade is taken on an upside breakout, a stop loss is placed just below the lower trendline. A profit target can be estimated based on the height of the triangle added or subtracted from the breakout price, different types of ascending triangles in forex.

The thickest part of the triangle is used. Here an ascending triangle forms during a downtrend, and the price continues lower following the breakout. Once the breakout occurred the profit target was attained. The short entry or sell signal occurred when the price broke below the lower trendline.

A stop loss could be placed just above the upper trendline. As a pattern narrows the stop loss becomes smaller since the distance to the breakout point is smaller, yet the profit target is still based on the largest part of the pattern. These two types of triangles are both continuation patterns, except they have a different look.

The descending triangle has a horizontal lower line, while the upper trendline is descending. This is the opposite of the ascending triangle which has a rising lower trendline and a horizontal upper trendline.

The main problem with triangles, and chart patterns in general, is the potential for false breakouts. The price may move out of the pattern only to move back into it, or the price may even proceed to break out the other side. A pattern may need to be redrawn several times as the price edges past the trendlines but fails to generate any momentum in the breakout direction. While ascending triangles provide a profit target, that target is just an estimate.

The price may far exceed that target, or fail to reach it. Technical Analysis Basic Education. Day Trading. Your Money. Personal Finance. Your Practice. Popular Courses. Technical Analysis Guide to Technical Analysis Technical Analysis Basic Education Advanced Technical Analysis Concepts. Technical Analysis Technical Analysis Basic Education. What is an Ascending Triangle? Key Takeaways The trendlines of a triangle need to run along at least two swing highs and two swing lows.

Ascending triangles are considered a continuation pattern, as the price will typically breakout of the triangle in the price direction prevailing before the triangle. Although, this won't always occur.

A breakout in any direction is noteworthy. A long trade is taken if the price breaks above the top of the pattern. A short trade is taken if the price breaks below the lower trendline. A stop loss is typically placed just outside the pattern on the opposite side from the breakout. Compare Accounts, different types of ascending triangles in forex. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear.

Investopedia does not include all offers available in the marketplace. Related Terms Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes, different types of ascending triangles in forex.

Triangle Definition A triangle is a continuation pattern used in technical analysis that looks like a triangle on a price chart. Rectangle Definition and Trading Tactics A rectangle is a pattern that occurs on price charts. It shows the price is moving between defined support and resistance levels.

Trend Trading Definition Trend trading is a style of trading that attempts to capture gains when the price of an asset is moving in a sustained direction called a trend. Triple Top Definition A triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way. What Is Range-Bound Trading? Range-bound trading is a trading strategy that seeks to identify and different types of ascending triangles in forex on securities trading in price channels.

Partner Links. Related Articles. Technical Analysis Basic Education Channeling: Charting a Path to Success, different types of ascending triangles in forex. Technical Analysis Basic Education Triangles: A Short Study in Continuation Patterns. Technical Analysis Basic Education Introduction to Technical Analysis Price Patterns. Day Trading Day-Trading Gold ETFs: Top Tips. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice.

Investopedia is part of the Dotdash publishing family.

The Never Fail Triangle Trading Strategy

, time: 35:01A Guide to Trading Ascending and Descending Triangles | Forex Trading Blog

22/04/ · Just like there are three little pigs, there are three types of triangle chart formations: symmetrical triangle, ascending triangle, and descending triangle. Symmetrical Triangle A symmetrical triangle is a chart formation where the slope of the price’s highs and the slope of the price’s lows converge together to a point where it looks like a triangle The ascending triangle chart pattern is generally considered a bullish formation and it usually forms during a currency pair uptrend as a continuation pattern. This ascending triangle chart pattern is confirmed when the currency pair price breaks out of the ascending triangle formation to the upside and closes above the upper resistance blogger.comted Reading Time: 3 mins 30/10/ · The ascending triangle pattern is similar to the symmetrical triangle except that the upper trendline is flat and the lower trendline is rising. This pattern indicates that buyers are more Estimated Reading Time: 5 mins

No comments:

Post a Comment