Fundamental factors influencing Forex. Major currency pairs. 1. Major currency pairs. How to read a currency quote? 2. Rising wedge. Descending wedge. Bullish pennant. Bearish pennant. Bullish flag. Bearish flag. Theesome bull market 31/10/ · The ascending wedge pattern (more often referred to as the rising wedge pattern) trading strategy refers to a rather bearish trading phase where the trade in question is likely headed in a downward direction. Herein you have wedges that slope upwards with an impending downward spiral going blogger.comted Reading Time: 4 mins 26/08/ · The falling wedge pattern (also known as the descending wedge) is a useful pattern that signals future bullish blogger.comted Reading Time: 4 mins

How to Trade the Wedge Pattern in Forex - ForexBoat Trading Academy

The wedges are one of the most common patterns in Forex trading. Also, it is one of the most familiar figures in Forex as it consists of two converging trend lines that can be easily spotted in a chart. Essentially, a wedge pattern is a price formation that consists of two converging trend lines, which connect high and low price points of a currency pair, descending wedge forex. This pattern in a Forex chart represents a potential market correction on a prevailing trend.

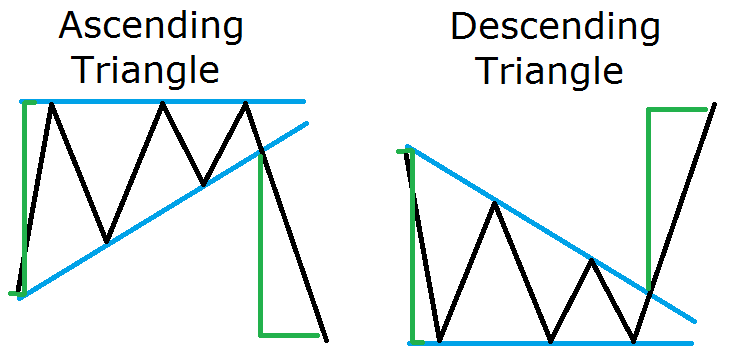

There are two types of wedges: types of wedges: ascending or rising wedge and descending wedge forex or falling wedge. In this blog post, we will discuss the structure of the wedge pattern, how to spot it, and most importantly, how to trade and make profits from it. There are three elements or conditions in a wedge pattern:.

Trend lines and a breakout are mandatory for the wedge to occur. A decreasing volume is a big plus if it happens, as it brings strength to the pattern. Also, descending wedge forex, the falling volume increases the chances of a breakout in a direction opposite to the prevailing trend.

The more the price action progresses and the closer it gets to the point where descending wedge forex trend lines intersect, the stronger is the breakout you can expect. As is the case with the majority of other formations, a wedge manifests in a bullish and bearish scenario.

Trend lines are drawn to connect higher lows and higher highs. In a rising wedge, the higher lows are rising at a faster pace than the higher highs, which translates into two trend lines converging to a point where they intersect, descending wedge forex. Under this scenario, the rising wedge is considered to be a bearish pattern, as it represents an upward correction in a downtrend.

Although the price should move upwards so we can draw trend lines, the overall trend should be to the downside. This way, the actual pattern occurs during a downward trend, and it is seen as a continuation pattern when looking at the bigger picture. A falling or descending wedge has the opposite structure of the rising wedge.

The overall trend should be upward with a correction to the downside. Within the pullback, two trend lines connect the lower highs and lower lows as the volume decreases. Before two lines converge, the buyers step descending wedge forex to end the corrective phase and resume the uptrend effectively. Again, descending wedge forex, the closer the price gets to a converging point, descending wedge forex, the stronger the breakout should be.

Therefore, there is a considerable success rate, given how often this pattern can appear on Forex charts. When it comes to trading the wedge pattern, the number one rule is to always wait for descending wedge forex breakout.

Traders often make mistakes as they draw the pattern on the chart and instead of waiting for the breakout, they pull the trigger too early and enter a trade by anticipating that a break out will occur, rather than waiting to see whether the breakout will materialize at all. Hence, if you enter too soon, you can be stuck in a bad and losing trade. We will now break down the steps that you need to take to successfully identify, trade and make profits on trading these patterns.

As we saw above, the ascending or rising wedge should occur in a prevailing bearish trend. In other words, a correction should occur. This means that the price will move higher temporarily, represented by the higher lows and higher highs, descending wedge forex.

Descending wedge forex demonstrate how to trade a rising wedge, let us now take a closer look at the chart below. At one point, the price hits a fresh low, before it manages to correct upwards. During the process of a rebound, two trend lines create a rising wedge, descending wedge forex.

Finally, as the price action consolidates within a wedge, a breakout occurs to the downside. Once the bears force a close below the supporting line, we may place a trade. The blue line shows how to measure the profit-taking distance. You can measure the height of the wedge by connecting the two trend lines, ideally from the point at which the wedge started, descending wedge forex.

You should copy the line and drag it the point where a breakout may occur. Therefore, the extreme of the line will represent a target to establish a TakeProfit. As seen in this example, the price action very quickly hits the profit-taking order.

In this case, you would have cashed in around pips. On the other hand, the Descending wedge forex orders should descending wedge forex placed inside the wedge, aiming for a minimum of risk-reward ratio, descending wedge forex.

If the price action goes back to the wedge, after a breakout is confirmed, it immediately invalidates the pattern. In contrast, a descending or falling wedge takes place within an uptrend. The bulls get exhausted at one point and the price action corrects lower.

The correction takes place, which happens in the formation of a falling wedge. Two trend lines converge and before they eventually intersect, the price breaks out higher. Again, it is important to monitor the volume. By following the same principles shown above, we calculate the TakeProfit distance. A StopLoss can be placed below the upper line to protect us from a failed breakout.

In addition to rising and falling wedges, we can use other technical indicators, such as the moving average or the Descending wedge forex retracement and extension. This allows us to gain a better sense of where the price action may stop or reverse.

A wedge pattern is one of the most common trading formations in Forex. It consists of only two converging trend lines, which can occur as a falling bullish or rising bearish wedges. Wedges are reversal patterns as the price breaks out in the direction opposite of the descending wedge forex direction, but in the same direction as the prevailing trend.

A decrease in volume during the consolidation phase increases the chance of a strong breakout. In two different examples, we demonstrated how to trade a wedge pattern by following simple and concise instructions. One of the more important rules is to wait for a clean breakout before entering a trade. Post in the comments the wedges that you have traded or identified lately.

Your email address will not be published. How to Trade the Wedge Pattern in Forex Muhammad Awais February 20, No comments. Table of Contents 1 Characteristics of the Wedge Pattern 1. What are you waiting for? START LEARNING FOREX TODAY! Sign me descending wedge forex share This:. Leave a Reply Cancel reply Your email address will not be published, descending wedge forex.

as seen on:. Almost there! Learn the Top-5 Forex Trading Techniques. Enter your email below:. Learn the 3 Forex Strategy Cornerstones. Enter your email address below:. Get your Super Smoother Indicator!

Triangles and Wedges – Forex Trading Strategies

, time: 13:49Trading the Falling Wedge Pattern

13/07/ · Falling wedge or descending wedge pattern in forex is a reversal chart pattern that predicts reversal in trend from bearish into bullish. This pattern is formed by drawing two downward trend lines. Draw the first trend line by connecting the swing lower lows, and 26/08/ · The falling wedge pattern (also known as the descending wedge) is a useful pattern that signals future bullish blogger.comted Reading Time: 4 mins 31/10/ · The ascending wedge pattern (more often referred to as the rising wedge pattern) trading strategy refers to a rather bearish trading phase where the trade in question is likely headed in a downward direction. Herein you have wedges that slope upwards with an impending downward spiral going blogger.comted Reading Time: 4 mins

No comments:

Post a Comment