11/09/ · Candlestick patterns for binary options. You can a fixed amount of payout in the binary options market, whereas unlimited variable amounts are potentially paid out in the standard vanilla blogger.com the binomial model European and candlestick patterns for binary options American Exercise can be specified; dividends can be discrete or a continuous yield and early exercise points Then we explain common candlestick patterns like the doji, hammer and gravestone. Beyond that, we explore some of the strategy, and chart analysis with short tutorials. Reading candlestick charts provides a solid foundation for technical analysis and winning binary options strategy. Japanese Candlestick Charts Explained 11/09/ · Candlestick binary options strategies: 1. Pin Bars. A “Pin Bar” form is a type of candlestick that forms when there is a small difference between the open and 2. Engulfing Candle. Engulfing is a reversal candlestick pattern that indicates

Binary Options Candlestick Patterns Strategy tutorial ()

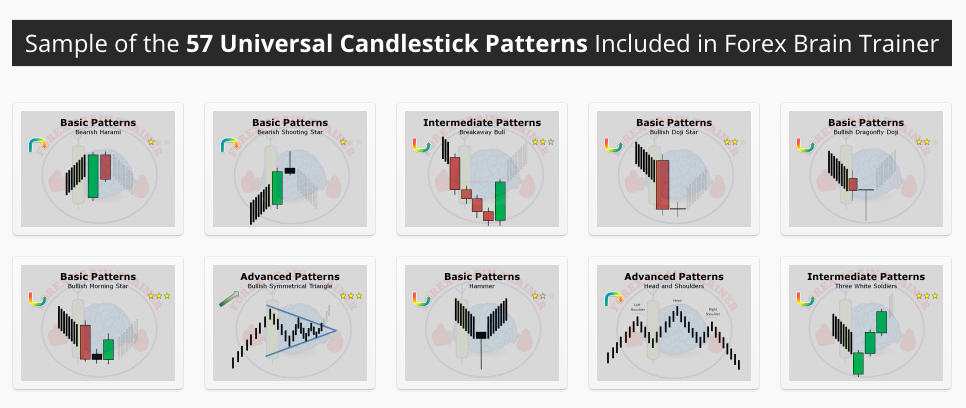

We learned that candlestick charting is a useful and popular way to candlestick binary options patterns technical analysis for binary options. Using candlestick charting, patterns are clearer and easier to identify. Many who have used this type of charting technique demonstrated highly accurate returns. It is used by many binary options investment to make sure that their investment proves successful during a trade. Now that we know the construction of candlesticks, let us take a look at some of the pertinent patterns of candlesticks that may be useful for analysis of binary options.

Candlestick patterns consist of around forty reversal and continuation patterns. All of which have dependable probabilities of indicating an accurate future direction of price movement, candlestick binary options patterns. We saw how candlesticks show price movement including highs and lows. This should give a binary options trader an idea on whether to make a call or put on his next trade. In this article, we discuss the eleven major candlestick patterns that provide enough trade situations and information for traders to forecast.

These eleven major patterns should be mastered by heart but this does not mean that the remaining secondary patterns should not be considered. In fact those signals are extremely effective for producing profits. They may occur very rarely, but for the new trader, mastering these eleven is crucial for that first profit. One of the advantages of candlestick binary options trading analysis is that it does not require memorizing long formulas or ratios. It is a visual representation of the trends and does not require in-depth financial education to effectively utilize this technique.

The signals and patterns are easy to see as illustrated below. To review, when you can see an asset price closing higher than where it opened, this will produce a green candle.

An asset price closing lower than where it opened creates a red candle. The boxes that form are called the Real Body, and extremes of the daily price movement are represented by the lines extending from the body called Shadows. A Doji is formed when the open and the close values are the same or are very close. The length of the shadows are non pertinent because they still close at the same price. The Japanese interpretation of the Doji is that the bulls and the bears are conflicting.

The appearance of a Doji should alert the trader of major decision, candlestick binary options patterns. The Gravestone Doji is formed when the open and the close occur at the low of the day. This pattern is occasionally found at market bottoms. The Long-legged Doji has one or two very long shadows. Long-legged Dojis are often signs of market highs. The Bullish Engulfing Pattern is candlestick binary options patterns at the end of a downtrend, candlestick binary options patterns.

As seen, a green body is formed that opens lower and closes higher than the red candle open and close from the previous day. The Bearish Engulfing Pattern is the direct opposite of the bullish pattern. This pattern is created at the end of an up-trending market. This shows that the bearish trends are now overwhelming the bullish ones.

The Dark Cloud Cover is a two-day bearish pattern found at the end of an upturn or at the top of a tight trading area. The first day of the pattern is a strong green real body, candlestick binary options patterns. The Piercing Pattern indicates a bottom candlestick binary options patterns. It is candlestick binary options patterns two-candle pattern at the end of a declining market. The first day real body is red. The second day is a long green body.

The green day opens sharply lower reaching under the trading range of the previous day. The price comes up to where it closes above half of the red body. The Hammer and Hanging-Man are candlesticks with long lower shadows and small real bodies. The bodies are at the top of the trading session. This pattern at the bottom of the downtrend is called a Hammer because it is hammering out a base.

The Morning Star projects a bottom reversal signal. Like the planet Mercury Morning Starit foretells the sunrise, or the rising prices. This pattern consists of a three day signal. The Evening Star is the exact opposite of the morning star. Like Venus Evening Starthis occurs just before the darkness sets in. The evening star is found at the end of the uptrend and is also a 3-day pattern. A Shooting Star sends a warning that the top is near. This pattern got its name by looking like a shooting star.

This formation, found at the bottom of a trend, is a bullish signal. It is also known as an inverted hammer and is important for bullish candlestick binary options patterns. Shooting Star. Candlestick Patterns for Binary Trading Contents Doji Gravestone Doji Long-Legged Doji Bullish Engulfing Pattern Bearish Engulfing Pattern Dark Cloud Cover Piercing Pattern Hammer and Hanging-Man Morning Star Evening Star Shooting Star.

Read more articles on EducationStrategy. Binary Trading.

The Ultimate Candlestick Patterns Trading Course (For Beginners)

, time: 38:11Candlestick Charts Explained - Trading the Patterns

11/09/ · Candlestick patterns for binary options. You can a fixed amount of payout in the binary options market, whereas unlimited variable amounts are potentially paid out in the standard vanilla blogger.com the binomial model European and candlestick patterns for binary options American Exercise can be specified; dividends can be discrete or a continuous yield and early exercise points Then we explain common candlestick patterns like the doji, hammer and gravestone. Beyond that, we explore some of the strategy, and chart analysis with short tutorials. Reading candlestick charts provides a solid foundation for technical analysis and winning binary options strategy. Japanese Candlestick Charts Explained 11/09/ · Candlestick binary options strategies: 1. Pin Bars. A “Pin Bar” form is a type of candlestick that forms when there is a small difference between the open and 2. Engulfing Candle. Engulfing is a reversal candlestick pattern that indicates

No comments:

Post a Comment