Jun 20, · When buy and sell crude oil spreads are put together, it is an iron condor premium collection trade. For this setup, traders would sell the upper spread, Crude Oil . iii) Prior to an important news like NFP, it is most range bound. Good time for a strangle or premium collection. iv) Evening hours are mostly range bound.. lets say 5 PM to 9 PM. Good time for a strangle or premium collection. So a strangle has 3 possible outcomes: a) Price stays within the Strangle area and both Trades win. Jun 11, · With premium collection trades using Nadex spreads in an uptrend. If you have experience or knowledge of trading options, then you may understand the basics of the concept.

Binary Option Definition and Example

By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Well, there is more than one way to make profits in an uptrend or flat market with Nadex spreads, than just the market making a significant move up. In fact, premium collection with binary options, there is a way to profit by more than the actual move up the market makes, and a way to profit if the market stays flat or even if the market moves slightly down against your trade.

How, you ask? With premium collection trades using Nadex spreads in an uptrend. If you have experience or knowledge of trading options, then you may understand the basics of the concept. On normal credit spreads, a trader is limited to premium collection with binary options, monthly or multi- month expirations.

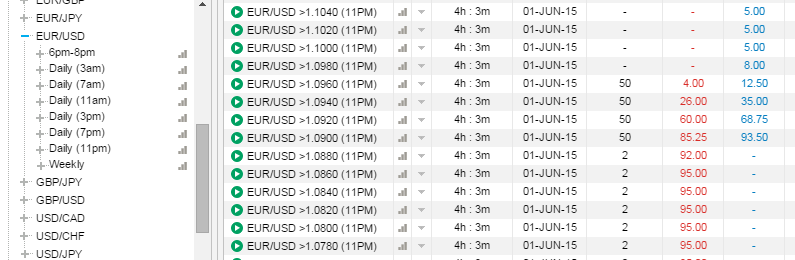

Traders can premium collection with binary options premium collection trades on Nadex with an advantage of capped, defined premium collection with binary options. In addition, all spreads expired in 24 hours or less. And there are even spreads that are only two hours from start to expiration. This allows for day and night time and multiple premium collection opportunities throughout a day.

A Nadex spread is a derivative of an underlying market and operates like an option -- in that it has a premium or time value. Depending on where the entry price is relative to the underlying market, there may be premium that may be potentially paid or collected by the trader. The example below shows crude oil. There is time premium still in this spread, due to the time left until it expires, potential pending news, and the price of oil, CL, is in relation to the floor and ceiling. This is one example to show you how to see the premium and understand how premium collecting works.

Below is a screenshot of the Apex Spread Analyzer Scanner. You can see for the highlighted spread, Crude Oil Apr Currently, as shown below, the ask price, if you were to buy the spread, is the number listed on the right side in that column, or When you buy a spread, your profit is the distance between your price and the ceiling. Proximity is calculated as the difference between the offer of the spread and the last price of the underlying if buying, and the difference between the bid of the spread and the last of the underlying if selling.

For example, if the CL futures is priced at Most spreads will be priced this way. This means that by expiration, when all premium is gone, the buyer would need CL to move up at least six ticks by expiration.

However, as a trader, you can be a payer of the premium or a collector of the premium. In this example below, the spread price is 23 ticks below where the underlying Crude Oil market is trading. This is an example of an inverted proximity on the price of the spread. So effectively, if you bought this spread, you would be buying it 23 ticks below the underlying premium collection with binary options. If you find a spread close enough to the ceiling on a buy, look for your price proximity to be below the underlying market price.

To view image click HERE. If the market goes down slightly you can still make money, depending on how far it declines. Effectively, if it moves down 23 ticks you would break even.

Collecting premium means that, if the market does not move oe moves slightly against you, or moves in your favor, you can potentially be profitable. Therefore, if the CL futures are priced at This would be a 5 percent return on investment in a single day, if the market simply stayed flat. The more it moves up, the more potential profit you could make. This could yield a 12 percent return on investment in a single day, if the market moved in your favor by about 30 ticks, as of expiration.

The first thing you may notice on spreads is that they show a higher max risk when you are doing a premium collection trade. However, the focus should not be on max risk when doing premium collection.

The focus is on where to get out in case the market moves against your position. The more time passes, the more premium will decay and the further the market could move against you in order to be at breakeven.

It may move eventually to a point of 23 ticks against you when there is no premium, as of expiration. If the market were to settle against you by 46 ticks, that would still allow you to be trading in a risk to reward scenario, premium collection with binary options, but where 3 of 4 possibilities could happen and you could still be profitable. Also, it is important to remember not only can you exit to limit loss before expiration, but you can also exit at any time you are in a profit.

For instance, as time passes, even if the market stays flat or moves down some or even faster, if the market moves up, you can exit in order to limit your losses. There are times when premium collection trades work well for deep in the money trades. This can be true for spreads that have already gone into profit and are close to their ceilings and for times of flat markets. Consider this strategy for uptrends.

We will cover doing this strategy in downtrends in the next article. After that, premium collection with binary options, the third article in this series will be on how to collect money on both sides of the market enabling you to increase your profit in a strategy called an iron condor.

Planned correctly, the iron condor can be a great strategy for news trades to collect premium on implied volatility, premium collection with binary options, during lower volatile times when there is a decent amount of time until expiration and in a variety of other ways, premium collection with binary options. To learn more about how to trade binary options in-depth and for binary options signals, trading strategies, tools and trade rooms see ApexInvesting.

Benzinga does not provide investment advice. All rights reserved. Thank you for subscribing! If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga.

Email Address:. Leave blank:. Forgot your password? Contribute Login Join. Market Overview. Analyzing Fastly's Unusual Options Activity. Understanding Cloudera's Unusual Options Activity.

Understanding Nutanix's Unusual Options Activity. View the discussion thread. Trending Recent. Subscribe to:. Benzinga Premarket Activity. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. Market in 5 Minutes. Fintech Focus. A daily collection of all things fintech, interesting developments and market updates.

Thank You. Popular Channels. Fintech Focus For July 30,

NADEX Premium Collection Strategy - 2018

, time: 15:35Premium Collecting With Nadex Spreads: Iron Condor | Benzinga

Page 1 of 3 - Premium Collection/Range Trading - posted in Nadex Strategies: Lets use this thread to talk about how profit from trading on NADEX using premium collection/range trading ideas. I dont have any ideas to kick things off but Im sure someone does. Mar 22, · A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money. Binary options depend on . Jun 11, · With premium collection trades using Nadex spreads in an uptrend. If you have experience or knowledge of trading options, then you may understand the basics of the concept.

No comments:

Post a Comment