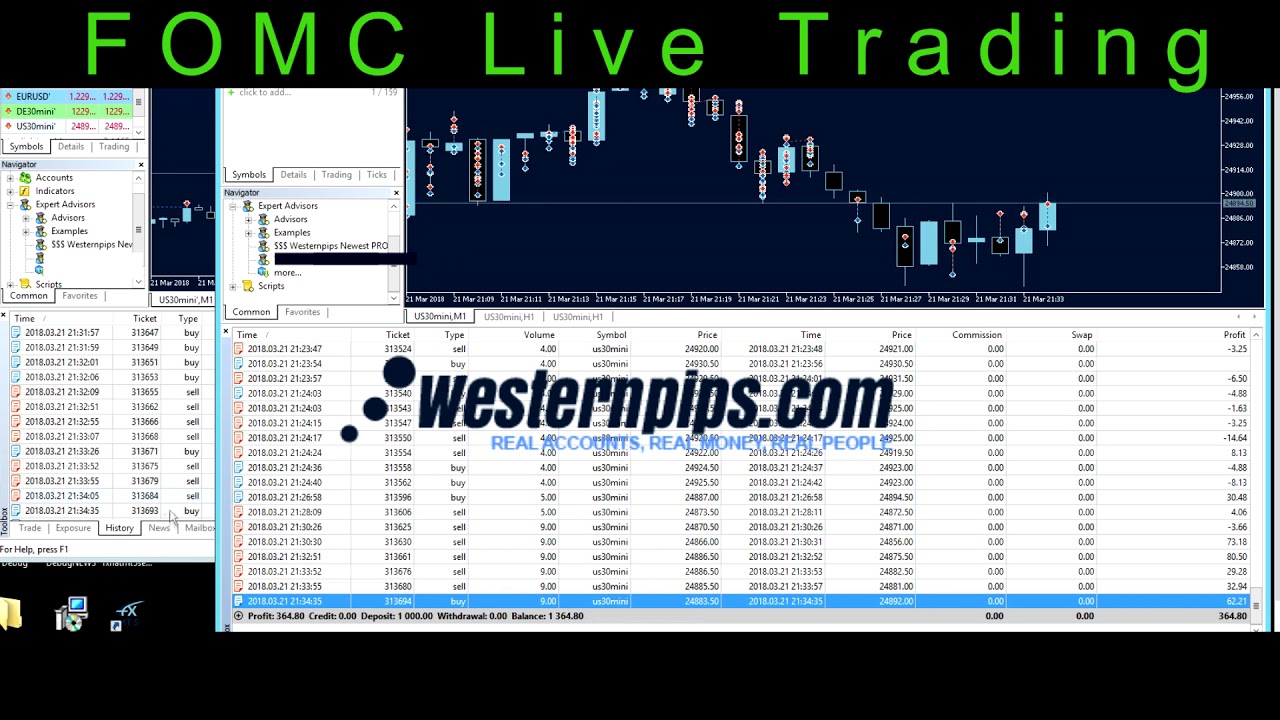

01/04/ · Forex Big Movement Robot is a fully automated Expert Advisor, which uses Extreme Movement Reverse System. It does not use martingale or grid. The system uses fixed stop losses for every position. Opening orders occurs after a significant increase/fall in prices. Extreme movements tends to return so many times 25/10/ · Here there are three system. Here I filtered forex milionaire in three ways. The first with Trend Half a trend following indicator fast. The second with the indicator Step Ma, the third with indicators of strength and trend-mometum (Williams’ Percent Range, and RSX CFB). The Best Time frame is Estimated Reading Time: 2 mins 23/02/ · How to predict forex movement? To predict forex movement, traders use past market price data, trading patterns, market sentiment, and fundamental analysis. However, the future price is tough to predict accurately, so professional traders create several possible price movement scenarios and analyze basic price levels

How to Predict Forex Movement? - Practical Example - Forex Education

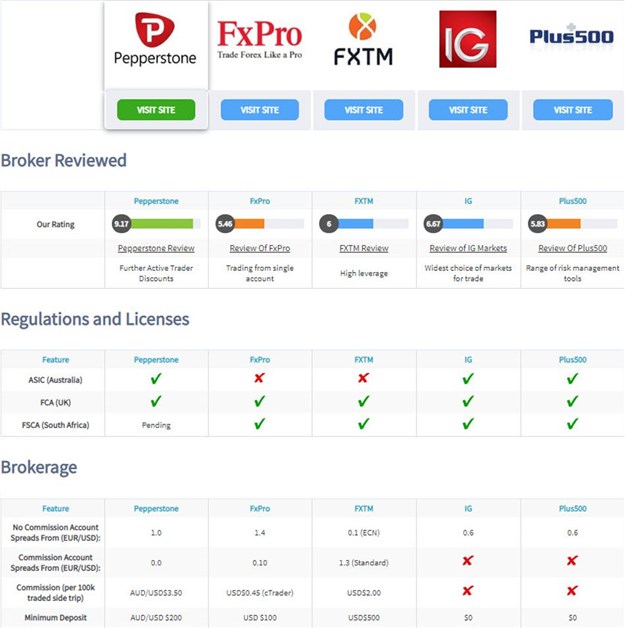

To trade any market requires knowledge and practice, but you know more than these two when it comes to Forex trading. Forex depends on a lot of factors other than the ones included in technical analysis.

These are fundamental factors, and they vary extensively from one country to the other. This makes predicting price movements in the Forex market more difficult.

However, with the help of specific tools and indicators, it can be made possible, forex counter with big movements. In this article, you will get to know all about Forex and how to predict forex movement. To predict forex movement, traders use past market price data, trading patterns, market sentiment, and fundamental analysis. However, the future price is tough to predict accurately, so professional traders create several possible price movement scenarios and analyze basic price levels.

Foreign exchange, or Forex, forex counter with big movements, is one of the most traded assets in the world.

The majority of this trade comes from big corporations and forex counter with big movements however, even small and individual traders collectively move currencies worth trillions of dollars every day. Two driving forces have a significant impact on Forex: demand and supply. There is one more thing that influences these driving forces. We call it sentiment, which innumerable factors can mold. This is called fundamental analysis.

The strength of a currency forex counter with big movements directly on the development and socio-economic stability of its respective country. Therefore, every positive or negative effect of a country has the power to appreciate or depreciate the value of the said currency.

Since it is almost impossible to predict all these events, investors use various tools and indicators to remove most risk factors. Fortunately, compared to the initial days, the tools and indicators available today allow traders and investors to make better trading strategies. They can implement a range of approaches and employ different methodologies to help them stay ahead in the game. We have created an outlook in this article on using different tools and indicators to make different approaches.

Before we discuss the types of approaches and decide which one is perfect for you, it is always better to brush up on the forex counter with big movements. First, you should know all about the currency pairs.

Forex is only traded in two currencies where the first currency is known as the base currency, and the other currency is called the counter or quote currency. It is essential to choose a pair wisely because most of the trading strategies depend on it.

These are major currencies, but you can find good opportunities by trading less popular currencies as well. Along with the choice of currency, you also need to give due importance to the time frame as it impacts the trading approach. Since the Forex market operates 24 hours, seven days a week, many traders open and close their position on forex counter with big movements same day, forex counter with big movements.

This is called day trading. Traders open a new position forex counter with big movements day when the market opens and close it at the end of the day, irrespective of their stand.

This is done to avoid any drastic price fluctuation that may happen overnight. Some traders believe in holding a position for a slightly more extended period. This period is up to 14 days, and this type of trading is called swing trading.

The strategies adopted by swing traders are similar to those that long-term traders, who hold a position for even forex counter with big movements, use. Swing traders, like long-term traders, also refrain from acting forex counter with big movements every price movement. Other than these proactive tradings, there are different types of Forex trading strategies that focus on the bigger picture.

Take momentum and range trading, for example, where traders look at price movements and analyze them to find long-term trends. In momentum trading, traders pay attention to an unusual price movement, whether up or down, to see if there is a scope for the beginning of a long-term trend. In range trading, traders lay stress on the levels of support or resistance.

They spot these levels in the past data with the expectation of seeing these levels again in the future. Range trading is suitable for currencies that show noticeable price movements, but there is no clear long-term trend. There are two types of analysis that traders do to see where the Forex market is heading and which currency pairs are more profitable.

These two analysis types are fundamental analysis and technical analysis. Fundamental analysis is based on the external and internal events that can influence the value or strength. On the other hand, technical analysis is solely concerned with patterns and trends. It predicts all the price movements based on the data that is available in historical price charts.

The aim is to predict future Forex trends based on stats, facts, and figures. To conclude, we can assert that fundamental analysis aims to identify either undervalued or overvalued currencies and find their real value in the process. Traders consider external factors that can potentially drive price. On the contrary, the technical analysis thinks of the laws of supply and demand as its principle. It focuses only on the currency price, forex counter with big movements. The aim is to check if the market trends will repeat themselves by studying previous stats and data.

The rest of the unquantifiable data is neglected in the process. To enter into a trade, traders need to have several triggers based on technical and fundamental analysis.

For example, a trader can enter into the trade after a strong bullish trend, for the example above yesterday high, during multi weeks bullish trend price above EMAand when Industrial production has excellent results. See the example below:. Fundamental analysis takes into consideration all the factors that can influence exchange rates. The main focus of fundamental analysis is identifying a mispriced currency that will correct itself over time as the external factors lose their power.

Fundamental analysis is not particularly short-term trading, although it is used in various strategies. It predicts long-term price movements. There are so many external factors that can influence the price of a currency. Some of these, like natural disasters or medical emergencies, cannot be predicted. However, there are some key economic indicators that you can learn about, forex counter with big movements, as these are important in terms of fundamental analysis.

The key economic indicators are:. Fortunately, most events are scheduled. Traders can check that calendar and stay in the know. An economic calendar includes all the essential political and economic events that are likely to happen in a country and can affect the currency, the financial markets, or the Forex in any way.

These economic calendars are essential guides to traders and investors. Various brokers offer economic calendars on their platform, including important central or federal banks like the Federal Reserve, the Bank of England, the Bank of Japan, and the European Central Bank.

Which key drivers are essential for you will be subjective as different external factors affect other economies. Not every key driver is equally important for every country. Therefore, you need to be careful while selecting your indicators. For example, the service sector dominates the UK economy. Another example would be China, which is a manufacturing economy. Even if the service sector remains stagnant, but the manufacturing unit shows steady growth, we will consider the Chinese economy to be expanding.

This is because the technical analysis does not revolve around price movements. It is centered around the concept of demand and supply. Traders rely on technical analysis using various price charts with data regarding the historical performance and exchange rate. Traders and investors use various tools and indicators to find past patterns and trends. It is done with the belief that these patterns will repeat themselves.

Technical analysts are of the view that one can gauge crucial information from even a single chart. Technical forex counter with big movements aims to let you know in advance when the mood might change and how you can leverage it for your benefit.

While fundamental analysis is more competent for finding long-term trends, technical analysis is majorly used for short-term plans and strategies. Day traders and swing traders rely heavily on technical analysis. There are various ways in which you can conduct technical analysis. But, there are a few historical data points and references that occur repeatedly.

For example, the opening price, the closing price, the lowest price, and the highest price. These are some of the standard parameters that technical analysts refer to while conducting the analysis.

One of the most critical technical analysis practices is to predict future exchange rate movements by using past data.

Traders look deep into the market data and look for similar signals and patterns. With the help of the past patterns that emerge in past data, traders analyze where the market is headed next. This may not sound very easy to you, forex counter with big movements, but traders use many tools to identify these patterns possible.

A sequence or similar occurrence of patterns creates a trend. It tells you that the most recent exchange rates of currencies will start a long-term trend. The length of this trend is stipulated by studying how an identical or similar trend panned out earlier.

Forex traders need to pay attention to three types of trends — Downtrend, Uptrend, and Sideways Trend. All the Forex trends are explained below:. A rising trend is an overall move higher in price, created by higher swing lows and higher swing highs. If you spot a rising trend or uptrend according to your technical analysis, you should see the exchange rate heading higher, and it will continue to climb up.

The downtrend is an overall move lower in price, created by lower swing highs and lower swing lows.

95% Winning Forex Trading Formula - The Forex Master Pattern��

, time: 37:53currency pairs with large movements | Make Money Forex

18/03/ · The U.S. currency pairs with large movements The euro moved in the benefits of Thursday and turned sideways as a sign of dollars. Suppo 23/02/ · How to predict forex movement? To predict forex movement, traders use past market price data, trading patterns, market sentiment, and fundamental analysis. However, the future price is tough to predict accurately, so professional traders create several possible price movement scenarios and analyze basic price levels 01/04/ · Forex Big Movement Robot is a fully automated Expert Advisor, which uses Extreme Movement Reverse System. It does not use martingale or grid. The system uses fixed stop losses for every position. Opening orders occurs after a significant increase/fall in prices. Extreme movements tends to return so many times